Welcome to Startups Weekly – Haje’s weekly roundup of everything you can’t miss from the world of startups. Sign up here to receive it in your inbox every Friday.

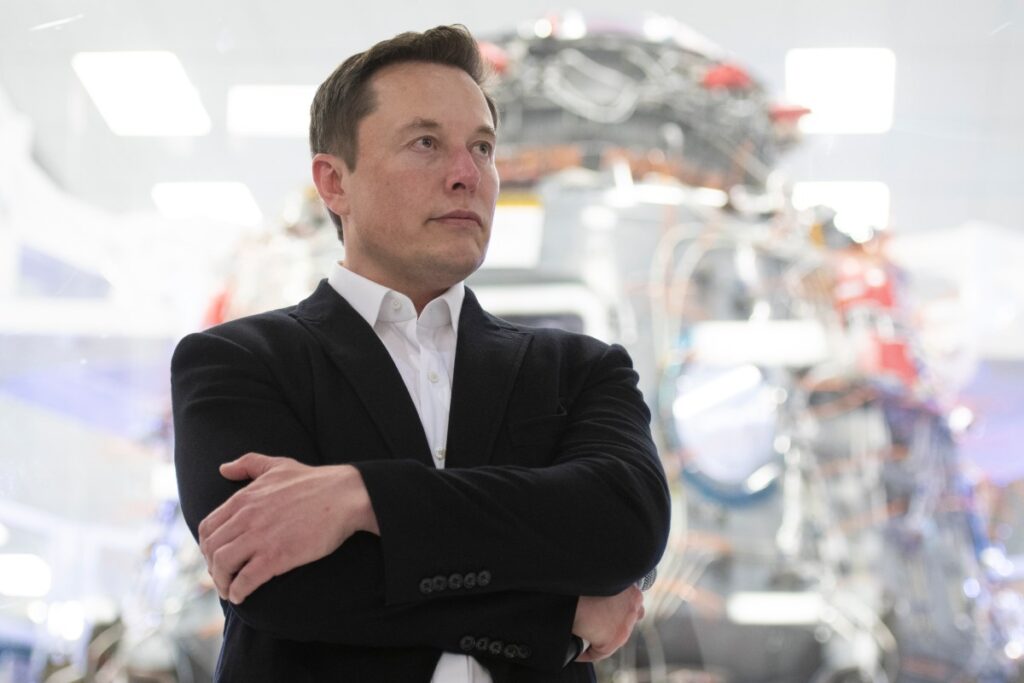

In a twist that shocks absolutely no one and excites arsonists who love to see money burn, Elon Musk’s newest venture, xAI, has snagged a $6 billion windfall in funding. Valor, a16z and Sequoia are piling the money on the xAI-shaped roulette table, with Musk spinning the wheel.

Ivan ponders whether Musk’s latest foray into the market will finally bring us AI so advanced that our puny human brains will be even more obsolete than they already are thanks to his other wild projects.

I think it’s totally annoying. These investors appear to be flush with cash and fresh from skepticism. I can only imagine the pitch: “Imagine an AI so powerful it makes the HAL 9000 look like a Roomba.” And, of course, they threw money at it. Because, well… I honestly can’t see the logic.

What makes this especially crazy is that the $6 billion figure is just the latest chapter in Musk’s epic saga of “how to get the world to fund my sci-fi fantasies.” The more stories come out about Musk, the more you’d think people would start to hesitate before investing. But apparently, that’s why I’m a newsletter writer and podcast host (we talked about this at Equity today too) and not a VC. I’d think twice before betting on the guy who gave us self-driving cars that can’t tell the difference between fire trucks and spaceships that sometimes land but sometimes explode in a fiery spectacle.

Today is your last day to save up to $800 on your Disrupt pass. Reserve your early bird pass by 11:59pm PT tonight!

The most interesting stories of the beginning of the week

Welcome to the Wild, Wild West of fintech! Remember that shining star called Synapse? Yes, it was a supernova. The banking-as-a-service startup was one segment that seemed to be careening into the stratosphere, and Synapse itself was backed by a16z – but that didn’t help matters. The company collapsed faster than my New Year’s resolutions. With 10 million consumers now left in the lurch and many fintechs scrambling to pick up the pieces, it’s a complete disaster out there. It’s like Game of Thrones, but with more spreadsheets and less dragons. If you thought your week was tough, spare a thought for those stuck trying to access their funds or save their jobs thanks to this mess. Buckle up – it’s going to be a bumpy ride ahead for fintech!

- Drama rides a motorcycle: James Khatiblou, the 37-year-old owner and CEO of Onyx Motorbikes, died just as his company was rolling into the sewer. With unpaid bills, an AWOL COO, angry customers demanding refunds for delayed e-bikes from China, and two former shareholders fighting for control over Onyx’s remaining assets… It’s one hell of a ride.

- Automotive job cuts LAND: Lucid Motors is trimming the fat again, laying off 400 employees (6% of its workforce) just in time for the launch of their first SUV. Apparently, they need to “optimize resources”. CEO Peter Rawlinson believes a lower headcount will help deliver the world’s best SUV… Meanwhile, Fisker has laid off hundreds of jobs in a desperate bid for survival. Employees got the hint when they were suddenly told to work from home – presumably so no one could hear the collective sighs of despair during everyone’s meeting.

- Collecting money to save money: Relay just raised a $32.2 million Series B funding round to help small businesses do more than just nervously refresh their bank balances. Their secret sauce? Focusing on mom and pop shops rather than tech startups – take that, Silicon Valley!

This week’s most interesting fundraiser

Firefly, the cloud asset management startup that’s all about simplifying your digital chaos with “infrastructure as code,” has snagged $23 million in funding. This comes after an unimaginable tragedy – CTO co-founder Joseph “Sefi” Genis was killed by Hamas at a music festival. Despite this, the Firefly team chose resilience over traction and went on to quadruple their revenue in 2023. So basically, Firefly is now solving the complexities of the cloud and going through real-world turmoil like absolute champs.

- This is excellent: Google just dropped a whopping $350 million on Flipkart, making it the latest VIP to back the Indian e-commerce powerhouse, which now has a valuation of $36 billion.

- You get a dinero! You get a dinero!: Sending money home just got a lot louder! Félix Pago, the fintech darling that makes remittances as easy as sending a WhatsApp, just grabbed $15.5 million in funding. Forget about downloading apps or navigating complex interfaces; this startup is using WhatsApp chatbot.

- A dictionary with a unicorn horn: More funding is pouring into AI-focused startups. DeepL, which builds automated translation and typing tools that compete with Google Translate and Grammarly, raised an additional $300 million. It is now valued at $2 billion.

More memorable TechCrunch stories…

Dreaming of Tech IPO Profits in 2024? Well, wake up and smell the high interest rates! Despite Reddit, Astera Labs, Ibotta, and Rubrik all getting a foot in the IPO door earlier this year, it seems most startups are still stuck at home in their PJs. Plaid’s CEO stated that they are staying private for now, and Figma and Stripe are busy making tender offers as if they are holding a bake sale rather than preparing for an IPO. Databricks raised $500 million, but isn’t even feeling the vibe of the public market; maybe next year they will feel more extroverted. And Canva? They may take so long to become public that by then we’ll be drafting newspapers directly from our brain implants. Stay tuned as TechCrunch continues to track which startups will hit the stock market runway or stay hidden behind their venture capital curtains!

More top stories:

- What is happening in the land of the messenger: Meredith Whittaker, president of Signal, has had it this far with the tech industry’s “scary guys” and their “bedroom guys.” At VivaTech in Paris, she didn’t hold back in her concerns about everything from US companies taking AI power to the EU’s misguided efforts at regulation.

- AI in your ears: Welcome to the battle of AI generating devices, now with Iyo’s GenAI headset! Humane and Rabbit R1 fell harder than a fish out of water, but Iyo thinks it can succeed where they failed. Unlike its predecessors’ weird lapel pins and overpriced handhelds that critics said should just be apps, Iyo is betting on an already beloved form factor: the Bluetooth headset.

- Dude, where’s my wallet?: Is it a bird? Is it a plane? No, it’s Ledger Stax, finally descending from the crypto skies 18 months after its grand announcement. This new high-end hardware wallet features an E Ink display designed by iPod guru Tony Fadell — yes, they’re bringing e-reader vibes to your crypto needs.

- Wait, Foursquare had 105 staff to lay off?: Foursquare just gave 105 employees the boot in an effort to “streamline” operations and put itself on stronger financial footing. CEO Gary Little, who might as well have hit the thing and then vanished into thin air, didn’t shed much light on what comes next.

- Let me sum it up for you: Looks like Apple is back to its old tricks, ready to sherlock another innovative app feature. This time, it’s Browser Company Arc that’s in question with its nifty AI summarization tools like “browse for me” and “summary to summarise”. Apple’s rumored “smart summaries” in iOS 18 sound suspiciously similar, potentially turning Safari into a one-stop shop for AI summaries of everything from web pages to missed notifications.